interest tax shield explained

Interest payments on loans are deductible meaning that they reduce the taxable income. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

Interest Tax Shield Formula And Calculator Excel Template

Therefore APV will be.

. Without the tax shield Company Bs interest. What is the benefit of a tax shield. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation.

And an interest expense of 10 million. An interest tax shield approach is useful for individuals who want to purchase a house with a mortgage or loan. Moreover this must be noted that interest tax shield value is the present value of all.

The interest tax shield is an important consideration because interest expense on debt ie. Interest Tax Shield 4m x 21 840k. ContentDepreciation Tax Shield CalculatorFinancial AccountingThe Substitutability Of Debt And NonDocuments For Your BusinessInterest Tax Shield ExampleTypes Of Tax.

While Company A does have a higher net income all else being equal Company. The value of a. The cost of borrowing is tax-deductible which reduces the taxes due in the current period.

Ad Aprio performs hundreds of RD Tax Credit studies each year. Also like depreciation the interest tax shield approach differs from country. It reduces the amount of your taxable income for the current tax year or defers it to the next year.

Ad We Provide Accountant Professionals that Creates Value for Your Work. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic. Ad No Money To Pay IRS Back Tax.

That is the interest expense paid by a company can be subject to tax deductions. This has been a guide to the Tax Shield Formula. Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million.

The extent of tax shield varies from nation to nation and their benefits also vary based on the overall tax rate. Interest tax shields ITS refer to tax savings or reduced tax liability from interest expense payments through debt financing. Partner with Aprio to claim valuable RD tax credits with confidence.

Such allowable deductions include mortgage. 100s of Top Rated Local Professionals Waiting to Help You Today. Such a deductibility in tax is known as.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. The debt load is of 50000 and it carries an interest tax shield of 15000 50000 30 7 7. The interest rate is 7 and tax rate is 30.

This interest payment therefore acts as a shield to the tax obligation. A companys interest payments are tax deductible. A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government.

A tax shield is a reduction in taxable income for an individual or corporation. The interest tax shield is positive when the EBIT is greater than the payment of interest. Ad Stand Up To The IRS.

Interest Tax Shield Interest Expense Deduction x Effective Tax Rate. The interest payment to debt holders.

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Interest Tax Shields Meaning Importance And More

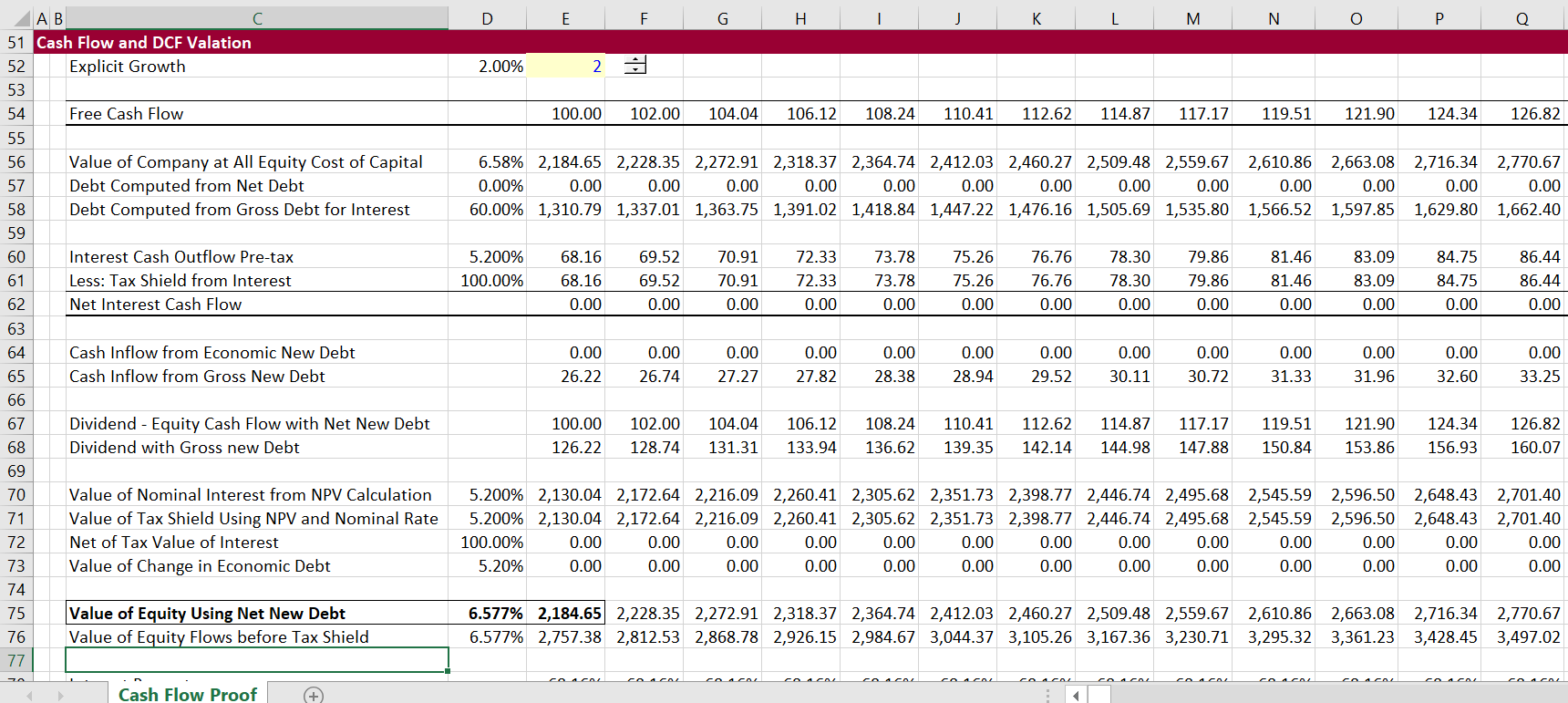

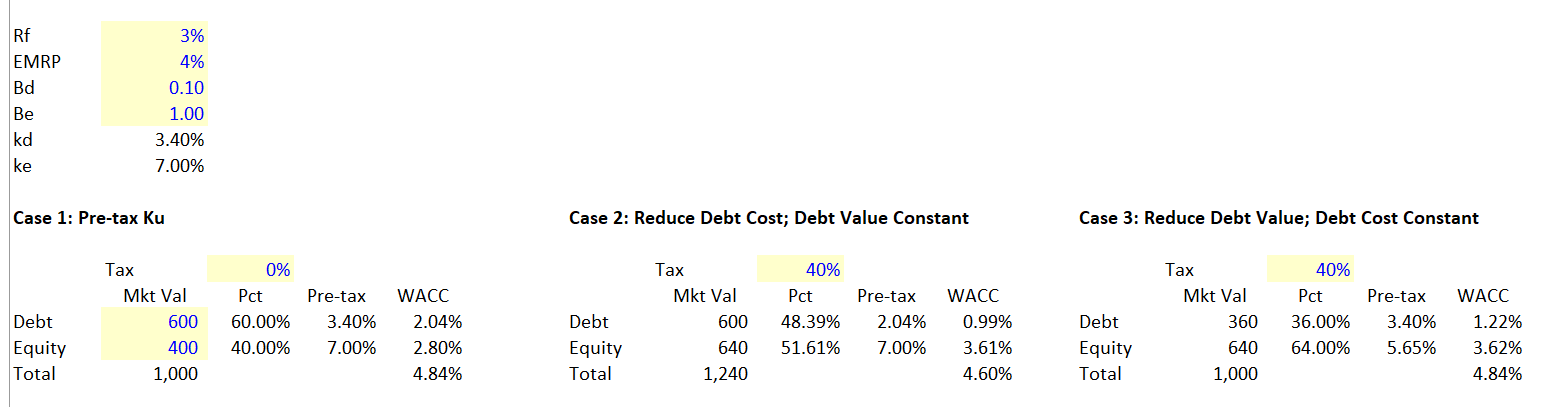

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

The Interest Tax Shield Explained On One Page Marco Houweling

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Meaning Importance Calculation And More

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Interest Tax Shield Formula And Calculator Excel Template

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance